Texas Weather Losses

Texas has the most severe weather in the country.

This loss and risk pattern is no accident.

Need stable regulatory structure.

Texas Insurance Marketplace Must Be Able to Weather the Storm

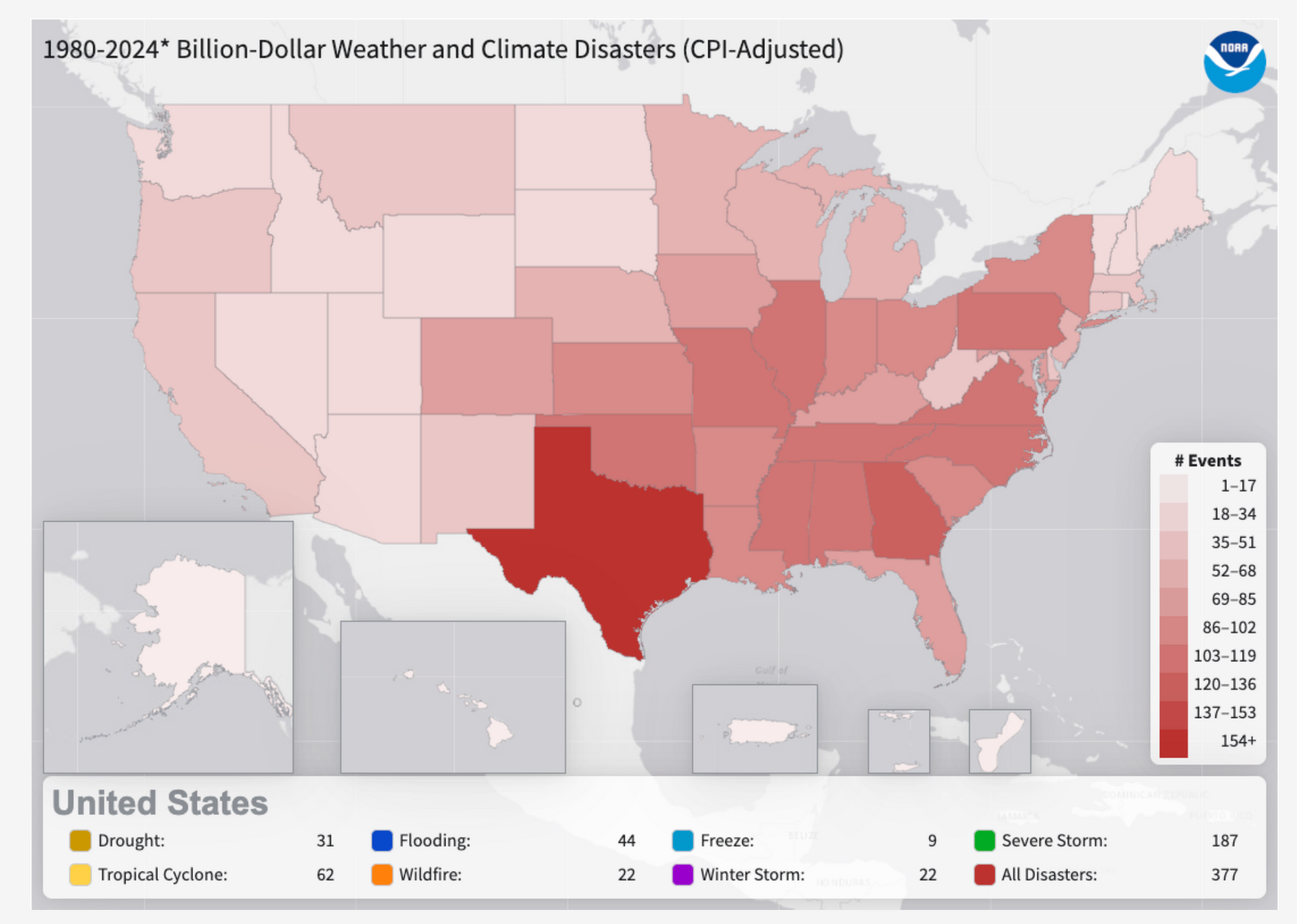

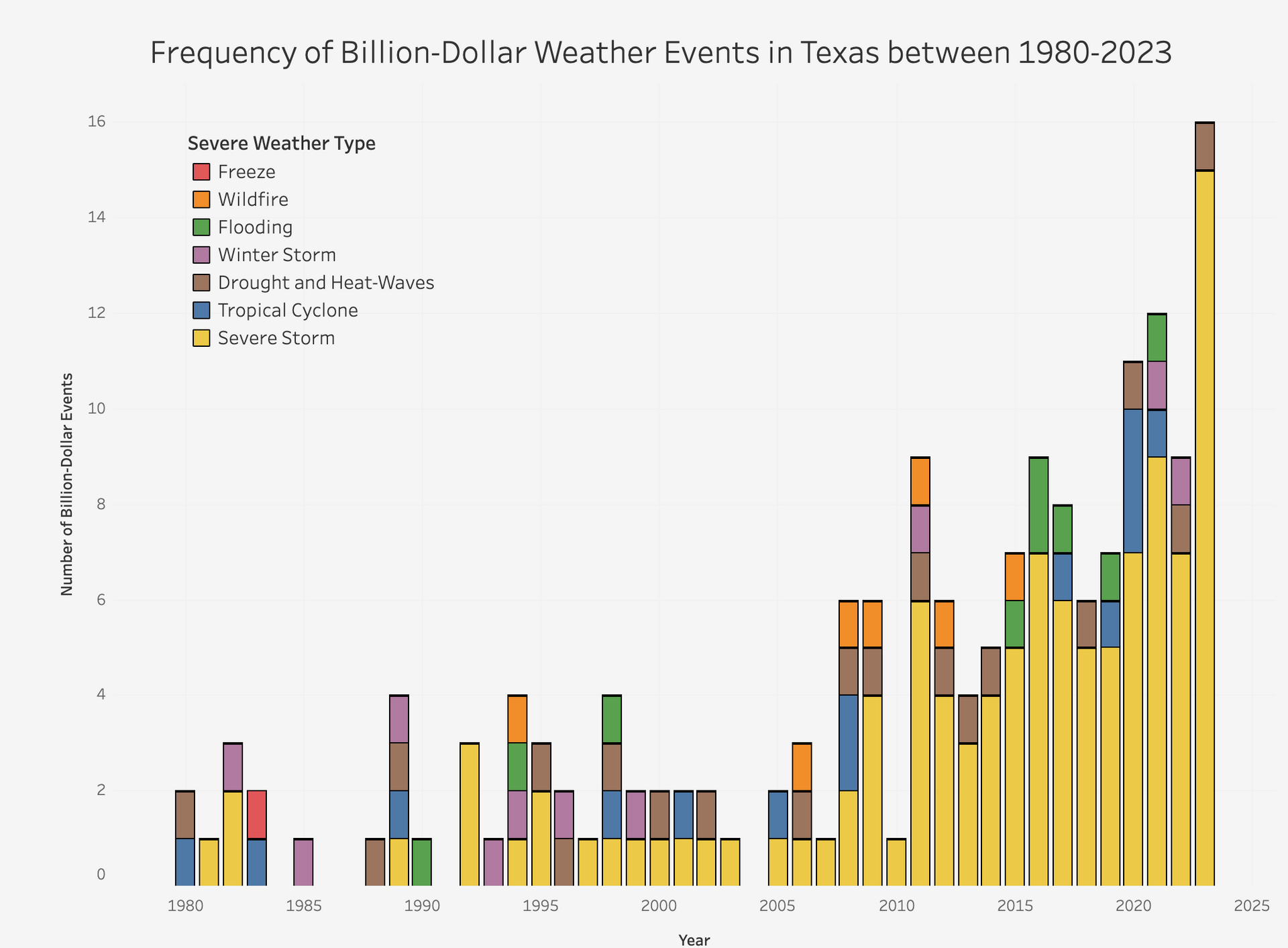

Resource: Download the USA Weather Chart – showing Texas has the most severe weather in the country – with exposure to nine different types of natural disasters – the most among any state in the country.

Texas has the most severe weather in the country.

Texas leads the nation in both the most frequent severe weather events and the most expensive, accounting for 15% of all U.S. billion-dollar disasters. From 1980-2024, Texas experienced 171 billion-dollar weather and climate disaster events. Compared to its closest rival, Louisiana, Texas had 77% more billion-dollar weather events. Comparatively since 1980, Louisiana had 97 severe weather events and Florida was third with 84.

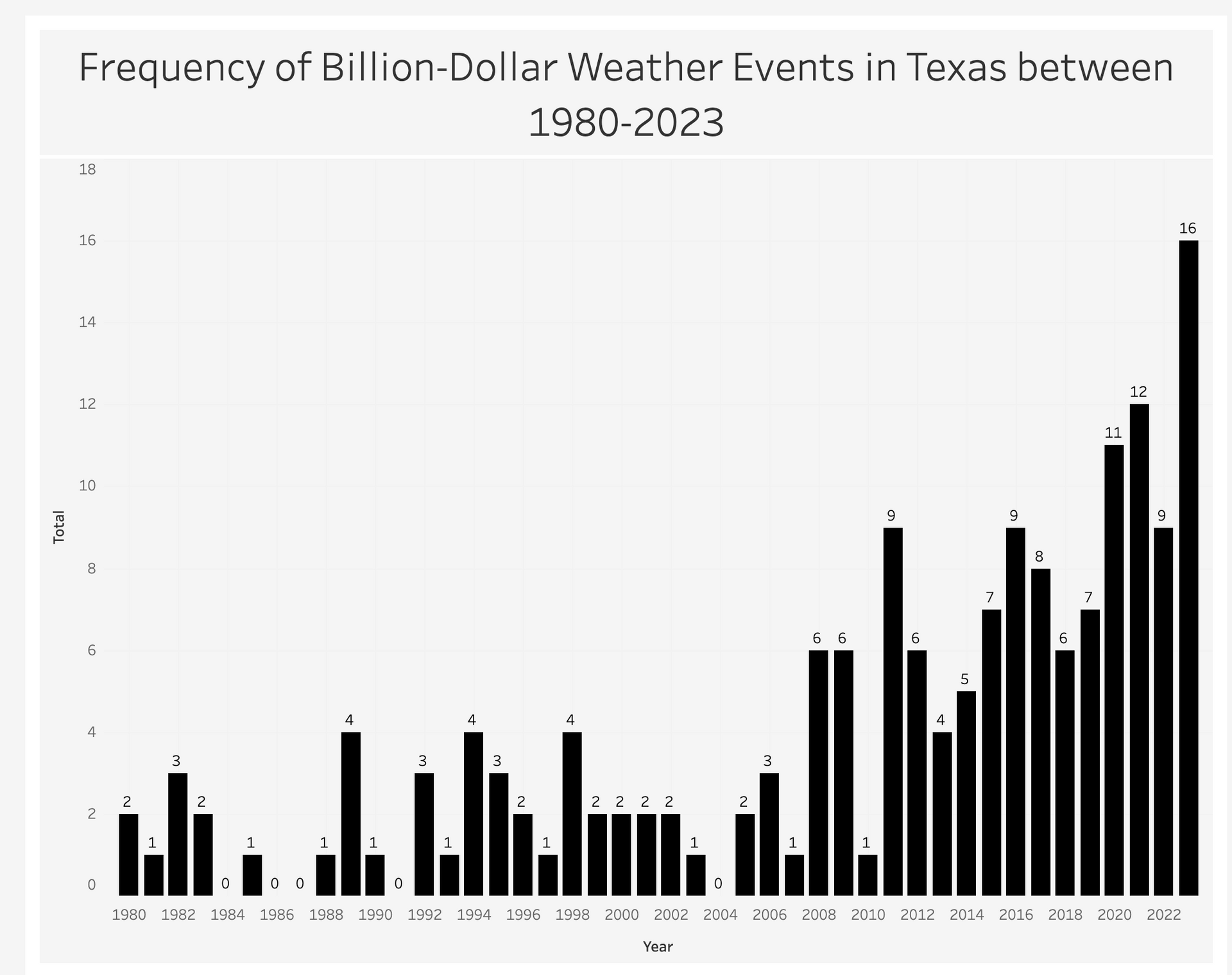

When viewing all of the severe weather events that have occurred in Texas between 1980 and 2023, there is an increasing trend in the overall number of disasters, especially in the last decade. Between 2020-2023, there were more than three times the number of billion-dollar weather events than those occurring in the 1980s (2020-2023: 48 vs 1980-1989: 14). The three years with the most billion-dollar events in Texas were in 2023, 2021, and 2019, respectively. Chart below from Texas2036.

This loss and risk pattern is no accident.

Although Texas has been subject to some of the biggest catastrophes to hit the United States in recent years, severity is only part of the story. Texas disasters come from a wide variety of events with a sad frequency. In a study conducted jointly by Kiplinger.com and Verisk Analytics, the authors observed that, unlike other high loss states such as Louisiana and Florida, Texas losses were largely “due to common thunderstorms and tornados, with the state enduring major wildfire loss, one tropical storm, four hurricanes, seven winter storms, and 53 severe weather incidents during the ten year study period.

Insurance costs are driven not only by weather, but also by the intersection of damaging events and insured value. Unfortunately, much of the severe weather risk in Texas is located over high population and construction concentrations. From the Panhandle to the Dallas-Fort Worth Metroplex, down the I-35 corridor or down! -45 to Houston, Galveston, and the coastal bend, Texas is built largely under severe weather risk.

The occurrence of frequent weather disasters over population centers creates a high level of both claims frequency and severity in our state. To put the values into perspective, Illinois, the tenth state on Kiplinger’s top ten list of disaster loss states, had weather disaster losses of $4.9 billion over the past decade. Texas suffered in excess of $1 billion of loss from a single afternoon hailstorm on June 13, 2012, more than 20% of Illinois’ ten-year total. And this storm is only the latest in a series of major weather losses suffered from McAllen to our northern borders that had already cost hundreds of millions of dollars, with the major part of wildfire, hurricane, and winter storm season still ahead of us.

It is critical to provide a regulatory structure that encourages companies to do business here.

Reforms passed in 2003 have stabilized premiums for most Texans even as home values have increased substantially; attracted new homeowners insurance companies to Texas; and increased choices and availability of coverage for consumers. Legislative and regulatory policies moving forward should continue this trend and focus on expanding insurance choice and availability in our state. A strong, competitive insurance marketplace, within a regulatory framework that focuses on solvency, consumer education, and consumer protection from fraud and unfair practices, serves the interests of consumers, insurers and the overall Texas economy that relies on available, affordable insurance.

Texas’ weather “accolades” include:

Bankrate: 10 states most at risk for major disasters

Texas ranked #1

Sterlings: Top 10 Places Most at Risk for Natural Disasters

6 are in Texas